Looking at the year-end headlines, the story of Ottawa’s real estate market sounds reassuringly familiar. Words like “stability” and “balance” were used, and you probably left with the takeaway of Ottawa’s doing what Ottawa does. It’s the kind of language that has long defined the city’s housing market and is one of the reasons people trust it.

But anyone who was actually participating in the market last year knows it didn’t feel that simple or similar. That disconnect between what the data says (which still reflects the predictable, historical patterns for the most part) and how the market felt. This is what’s worth unpacking.

Challenging the Narrative

According to OREB’s December and year-end reporting, Ottawa closed 2025 on a note of stability. Sales activity cooled, but prices held strong within a narrow range. This is in line with the typical seasonal trend where sales volume softens in late fall and into winter. From a distance, Ottawa’s market did what it usually does. Yet, from the inside, 2025 felt anything but routine.

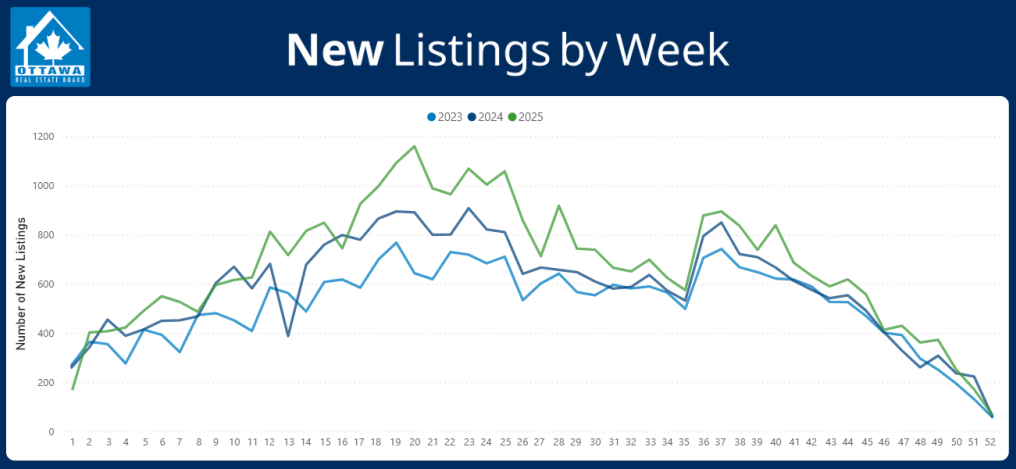

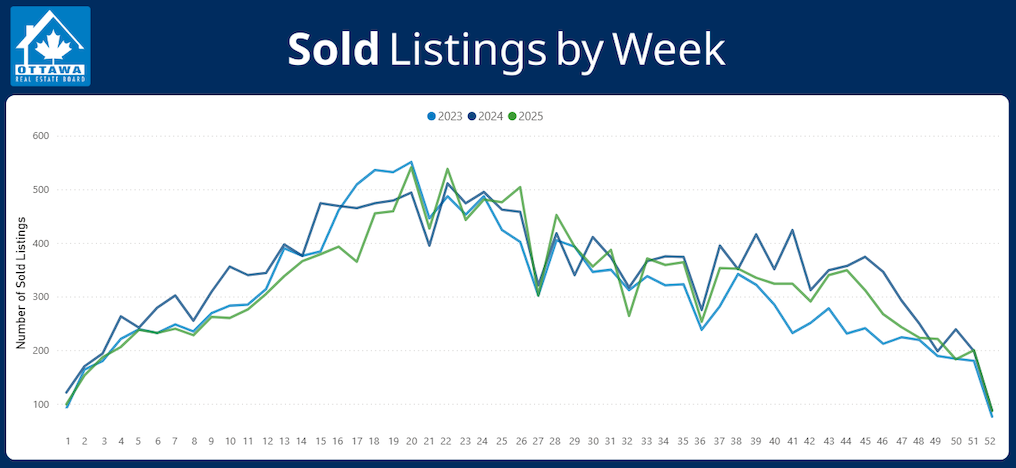

One of the narratives emerging from the end-of-year commentary is that 2025 followed an unconventional seasonal pattern, “beginning with a delayed spring, transitioning into a steady summerthat avoided the usual mid-year dip, and then moderating again through the fall and early winter.” But when you look at the data, the mid-year dip didn’t disappear. It was very present.

|

|

|---|

Sales activity still peaked, slowed, and recalibrated in familiar ways, and the shape of the graphs remains strikingly consistent with recent years. Week to week, month to month, people behaved almost the same. When behaviour repeats itself this consistently (statistically speaking), the market is doing the same thing… even if the experience of it seems unique.

It’s a bit of a paradox, this same, same but different. We followed established patterns, but the movement within them was louder and more uneven. That mismatch between perception and performance is interesting because real estate is driven as much by psychology as it is by raw numbers and fundamentals. To put it simply, when people feel uncertain, they act differently.

In real estate, this results in home buyers hesitating longer but then moving swiftly when the right property appears. Sellers will sometimes anchor themselves emotionally to previously seen peaks, even though conditions have changed. And investors reassess risk tolerance instead of just assuming perpetual value appreciation. So how do we reconcile a statistically stable market with one that’s psychologically a little more apprehensive and unsettled?

A Constellation of Connections

The answer lies somewhere outside the current housing stats. 2025 unfolded against a backdrop of global trade tensions and tariff uncertainty, heightened cost-of-living pressures, federal workforce uncertainty in a government-driven city, and much, much more. None of these forces operates in isolation. They form a constellation that shapes people’s reality, how they interpret risk and opportunity, and influences behaviour.

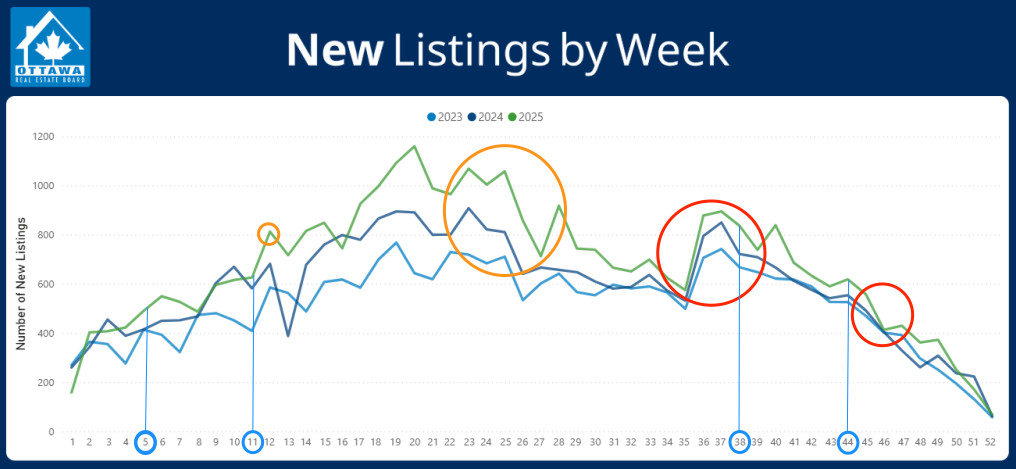

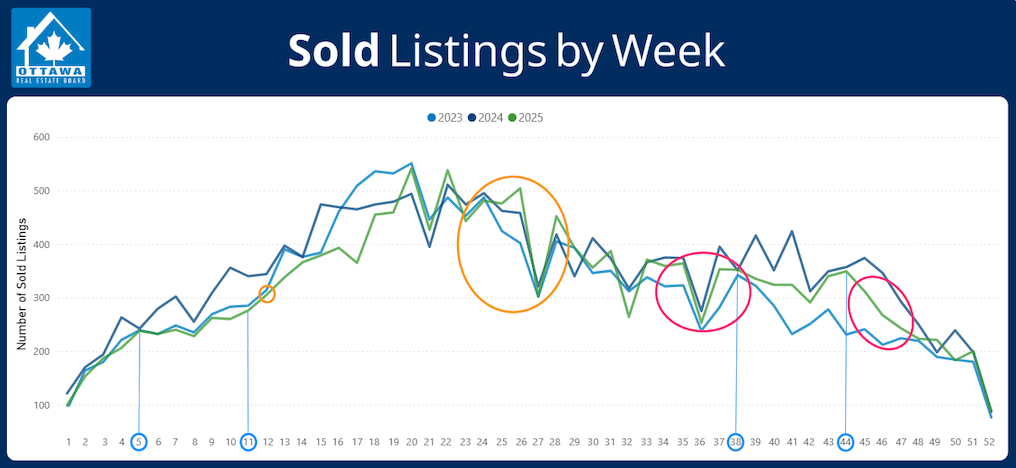

Overlapping some of these events with the OREB data shows that the repeated Bank of Canada rate cuts didn’t have much of an impact on trendlines. Despite easing affordability in certain ways, it didn’t erase any of the anxiety or other emotions at play. The impact on the Canadian housing market due to US trade and tariffs tensions, signalled as early as mid-March by the OECD, can then be seen clearly mid-year in terms of new and sold listings. As a reminder, June is when reports started confirming that Canadian housing price growth was indeed slowing down.

|

|

|---|

In late August and early September, news of the federal government job cuts in Ottawa started to circulate. And come November, when the federal budget was tabled and passed, confirming this news, we were already in our well-established seasonal end-of-year slump. In other words, have we started to see the impact of this yet? Meanwhile, the final few jobs reports last year were better than expected, adding credence to the resilience (or not as bad as it seems) narrative.

So despite all the turbulence and noise, the 2025 real estate data offers some grounding truths:

- Consumer behaviour and seasonal rhythms remain remarkably consistent with previous years.

- Ottawa’s market continues to self-correct rather than swing wildly, GTA, we’re looking at you!

- Price stability doesn’t mean uniformity because market segmentation is definitely occurring.

Ottawa’s real estate market is actually multiple interconnected and changing markets where geography, property type, and underlying motivations matter more than ever. The stratification between these markets and their participants is a big reason why the past few years have felt so different, despite the typical statistical outcomes. This is likely to continue in 2026.

Forecasting in “Unprecedented Times”

The best predictor of future behaviour is previous behaviour… right?

That’s why we use data in models for forecasting and predictions. The challenge moving into 2026 isn’t that Ottawa’s market is detached from its data-driven fundamentals. It’s that we’re forecasting in an environment where political, economic, and social turbulence is more present than it used to be. All of this needs to be incorporated into models now, rather than waiting for the data to reflect it in six months from now.

As we move through 2026, the goal shouldn’t be trying to predict every twist and turn. But to make confident decisions, they need to be grounded and informed by data and context. They also need to prioritize your personal circumstances. Not market speculation, fear, or fatigue. And this is where Top Ottawa Homes continues to focus its work. We want to help you understand what the numbers say and the why behind them.

Leveraging our combined brokerage, realtor, and appraisal experience, Top Ottawa Homes provides you with enhanced knowledge and visibility into the housing market. Before you make your next move, reach out!